According to an annual report card called “Quality Counts,” from Education Week’s Research Center, overall, Texas got a C-. It got the same grade for student achievement in grades K-12. It posted a C on students’ chance for success later in life. But on school finance, Texas got a D.

This year Texas, dropped slightly to 43rd place among all the states and the District of Columbia. Massachusetts won the top ranking again, earning a B+ overall. Nevada ranked the worst with a D. Overall, the nation received a C average. For Texas school districts that will be losing Additional State Aid for Tax Reduction (ASATR) funding this year, the grade might just be an F.

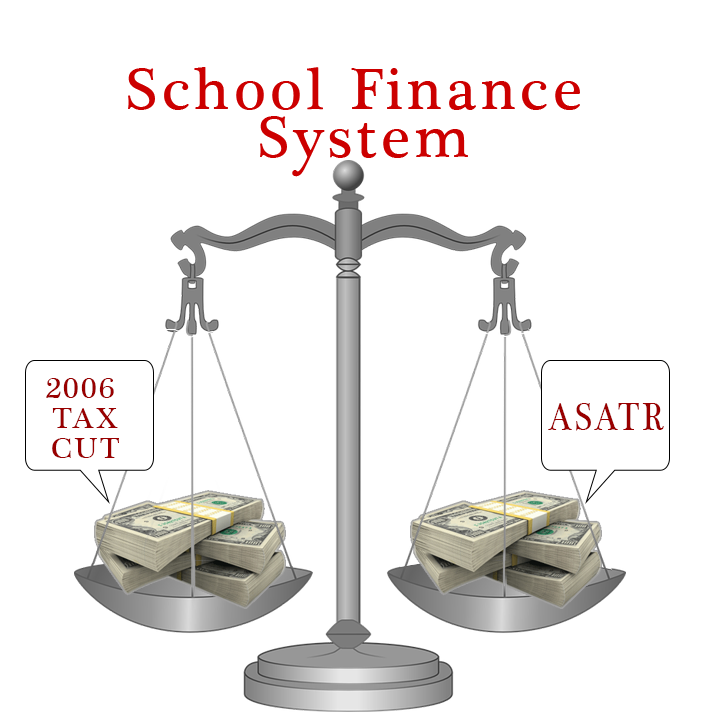

When the Texas Legislature reduced property tax rates by one-third in 2006, they guaranteed that school districts would have the ability to maintain at least the same level of per-student funding for weighted average daily attendance (WADA) as they received for the 2005-2006 school year by creating ASATR, also referred to as a Hold Harmless provision. “When the state compressed the tax rate down to a dollar, that’s when ASATR took place,” said Executive Director Texas Rural Education Association Don Rogers. To make sure that districts would not lose revenue due to this legislation, they received state aid. Around 190 school districts fit into this formula for additional funding. Instead of funding schools based on the formulas school districts currently use, schools were simply guaranteed the same amount of funding they got in 2006.

Three bills were introduced during the 85th Legislative Session that would have extended ASATR for a couple of years. They were House Bill 308, House Bill 527 and Senate Bill 419. “Even the School Choice House Bill 21 had assistance for ASATR districts,” said Rogers. “The House wanted to put an additional $1.6 billion into public schools and that included some help for those ASATR districts. The Senate wanted to cut that to $530 million and provide vouchers for special needs students and that was a fall on the sword issue for either side.” Rogers was in favor of another bill that did not last long during the legislative session. Sen. Larry Taylor’s Senate Bill 2145, was developed by the Equity Center, an organization that represents school districts that collect less revenue from local property taxes. The bill had a proposed formula that would provide the same base per-student funding to every district, with additional money for English language learners, students with disabilities, economically disadvantaged students and students receiving training for technical jobs. That funding would then be multiplied by the local district’s tax rate. Districts with higher property tax rates would get more money than those with lower property tax rates.

“They did fund growth during this year’s session,” said Rogers talking about some of the positivity for school districts from this year’s legislative session. “They estimated there would be about 80,000 new students in the next two years and they did allocate for that. But beyond that, inflation and other extra costs were not funded. In 2016, the supreme court said we had a terrible system although they decided that it was constitutional to have a terrible system. They blessed it but said it was terrible. One school might be getting $4,200 per pupil and one district over, just because of how their taxes were when the compression took place, they get $300 or $400 less.”

Rogers is referring to the Texas Supreme Court that upheld the state’s school finance system in 2016. The case was brought against the state by more than two-thirds of Texas school districts. This was the seventh time such a case has reached the state Supreme Court.

Fort Elliott Consolidated Independent School District is a district feeling the loss to the tune of about $800,000 in ASATR funding, according to Frank Belcher, Fort Elliott CISD superintendent. “We are in the process of making as many budget cuts as we can,” said Belcher, who recently came out of retirement to lead the district. Belcher served 10 years as the superintendent at Canadian ISD and two years at Wheeler ISD. “We are not in threat of closing this year, but we are in the process of cutting everything we can just to get us to a level where we can maintain our school. We are going to have to raise our tax rate to as high as we can get it. We were not at the dollar so we are going to have to raise our tax rate to either a $1 or $1.04.” Since that is the district’s rollback rate, they will not have to hold an election. The district also plans to move the elementary school to the main campus in Briscoe.

School districts will need to raise their tax rates to make adjustments, but raising taxes isn’t really that popular. ‘When you go beyond a dollar you fall into another category they call a Tax Ratification Election (TRE) where people authorize you to go to the maximum tax rate which is a $1.17,” said Rogers. Six cents of that is what we call golden pennies and so you get state funding and then it is equalized. And so if that penny doesn’t raise as much money on the state average then you get state money for those debts. When you go beyond a $1.06 then you will get whatever your local tax base will generate. It’s kind of a complicated thing but many school district have to have an election to go beyond a dollar.”

Texas law requires school districts to calculate two tax rates- the effective tax rate and the rollback tax rate- after the district receives the certified appraisal roll or certified estimate of taxable value from the chief appraiser of property throughout the district. If a school board adopts a tax rate above its rollback tax rate, it must hold an election to ratify that rate. If the proposition is not approved, the district may not have a rate higher than the rollback rate.

In some circumstances, a higher rate may be adopted without the need to conduct a TRE. If a district has reduced its maintenance and operations rate for one year, it may be able to raise its M&O rate in the subsequent year without conducting a TRE. A TRE must be conducted 30 to 90 days after the date the tax rate is adopted. If the November 7, 2017 uniform election date falls within that period, a district must hold the TRE on the uniform election date.

The ASATR districts will also be cutting or not replacing educators when they leave their position and that means the pupil/teacher ratio will go up and there will have to be some creative ways of operating. “I have been around a long time and I can remember some creative things we did when I attended school,” said Rogers. “We would combine grade levels and there would be third and fourth graders with the same teacher. When I started school I went to a one-room school house in south Texas. There were six grades in one room and we had six rows and whichever row you sat on was your grade… and somehow, we made it work.”

Strategic Partnerships, Inc. is one of the leading government contracting consulting firms in the county. Contact them today to learn more about growing your public sector business.